Term deposits vs bonds: a guide to fixed income investments

Mar 11th, 2017

Term deposits vs bonds: a guide to fixed income investments

For Australian investors seeking certainty their capital will be preserved as well as a predictable income stream, term deposits have typically been the go-to fixed rate investment. However, while they are still an important part of your portfolio, current low interest rates make their yield far less attractive – especially once you factor in inflation.

"With many of our clients looking for lower risk recurring income, we are seeing increased appetite for investment grade bonds," says Citibank Product Specialist Simson Sanaphay.

Bonds are a popular defensive asset class globally, but not all bonds are created equal – there are hundreds of different bond categories available on the global market, ranging from relatively safe (but low yield) government or treasury bonds to higher yield corporate bonds.

So should you invest in a term deposit or bond? Let’s take a look at the pros and cons of both options.

1. The hunt for higher returns

A yield is the expected return on an investment. For term deposits, this is the interest rate, which is typically locked in for the duration. Right now, cash rates are low and are expected to remain lower for longer in Australia.

Bonds are issued by companies or governments as a way of raising capital – they ‘borrow’ money from you as an investor, so it’s a form of debt. They are legally obliged to pay you regular interest (called a ‘coupon’) and once the bond matures they must return the face value of the bond to you.

This means the yield can be measured as the interest rate they pay you. But as bonds can also be traded on a secondary market, their prices can move up and down (although not by as much as shares in the same company) – giving you the potential for additional yield through capital gain if you choose to sell before the bond matures.

Because bonds are slightly more risky than term deposits, they tend to offer higher interest returns. But there are much wider variations on yield between government and corporate bonds – reflecting the perceived higher risk of a corporate bond investment.

"The coupon rate depends on the credit strength of the issuer, expected inflation and interest rates, where the bond sits in seniority of claim (in the case of insolvency) and investor demand," explains Sanaphay. "This means issuers have the potential to offer higher yields despite a low interest environment."

As well as gaining potentially higher returns, bonds provide longer-term income certainty.

"Citibank offers bonds to wholesale clients from one year to 10 years, which gives clarity about recurring income. A Term Deposit is typically reset at the market interest rate, which is challenging right now."

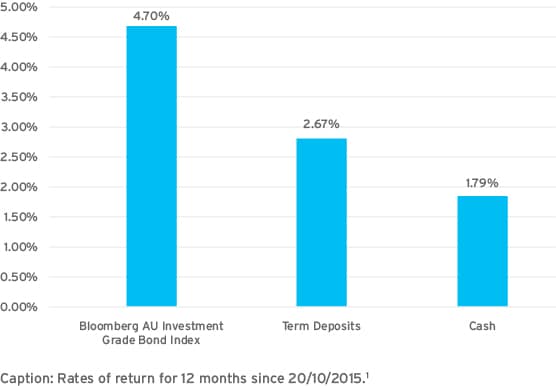

Verdict: As this chart shows, bonds typically offer higher yields than term deposits or cash rates, but different type of bonds will vary.

2. Capital stability

Term deposits are protected by government guarantee on amounts up to $250,000 with any one institution – and as such, are the safest investment you can make.

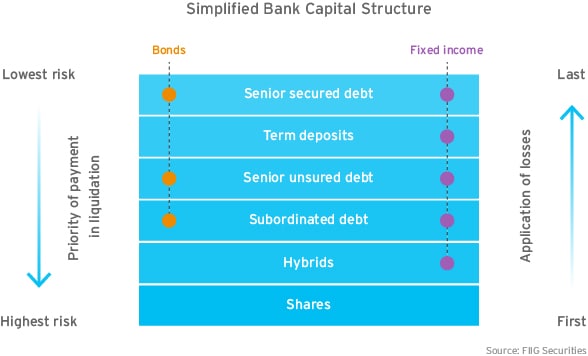

Bonds are classed as senior secured or unsecured debt, or subordinated debt, which places them high up in a bank capital structure. This means bond investors are prioritised over equity or hybrid investors if the issuer becomes insolvent.

As a result, there is a strong degree of certainty you’ll get your bond face value back at the maturity date. If a bond issue carries a higher risk of running into financial difficulties, you should expect a higher rate of return.

Verdict: Term deposits are safer than bonds – but bonds still offer more certainty than equities or hybrids.

3. Liquidity

Once you’ve invested in a term deposit, your savings are locked away for that fixed period and if you want to access your funds you’ll find there’s a 31 day notification period for early termination – and you will forgo interest.

"Bonds are liquid and can be bought and sold at the prevailing price, in a similar way to shares," says Sanaphay. "As a global bank, Citibank can bring buyers and sellers together from across the globe to trade on the secondary bond market."

When interest rates are low or falling, the bond’s face value may increase on the secondary market – and the cost of trading is relatively low. On the other hand, there is also the risk it will be priced at a discount.

Bonds are a popular defensive asset class globally, but not all bonds are created equal with hundreds of different bond categories available on the global market.

"Newly issued bonds generally offer greater potential for price appreciation and better liquidity," comments Sanaphay.

Verdict: Bonds offer more flexible access to funds, but you need to monitor their value before you decide to trade.

4. Diversification

Your choice of term deposits is limited to institution and interest rate. But you can invest in a broad range of assets through bonds – from local corporations to global enterprises not available on the ASX, such as Apple, Intel and Coca Cola. Bonds also give you access to long-term income producing infrastructure (such as airports), universities and governments.

Generally, when equities underperform, bonds outperform – because when markets are unpredictable bonds look more attractive to investors – in fact, corporate bonds and Australian equities often move in opposite directions. So investing in bonds also helps you mitigate the risk of your equities portfolio.

"Bonds come in many forms – fixed rate, floating rate, callable and step-ups," says Sanaphay. "Credit quality varies widely, so by focusing on total portfolio returns through a diversified strategy, investors could achieve higher overall returns."

While most bonds are issued as fixed rate, some investors may choose to diversify their bond portfolio with inflation-linked bonds (which hedge against rising inflation) or floating rate bonds (which pay variable interest). Callable bonds may be redeemed by the issuer prior to maturity, while step-up bonds will pay an initial coupon rate for the first period and then a higher rate for subsequent periods. "This can be make them attractive for investors – especially if there’s any risk of credit rating downgrade," Sanaphay explains.

Both bonds and term deposits offer control over the length of investment time, so you can also stagger your bond maturity dates or deposit terms to release capital at certain points – depending on your investment goals.

Verdict: Bonds can help you diversify your portfolio across different asset classes and markets – and manage the risk of inflation or interest rate changes.

5. Accessibility

Citibank offers direct investment in bonds to wholesale clients only, with a $50,000 minimum investment – which may be restrictive – wholesale investors have an annual income of over $250,000, or net assets in excess of $2.5million - as certified by an accountan. If you’re interested in bonds as a retail investor, consider a managed fund – it will invest in bonds on your behalf.

Verdict: If you’re not a wholesale investor, term deposits are certainly easier to access, with lower minimum deposits.

Like any investment, it's important to consider your financial goals when you’re weighing up the relative risk and return of these two fixed income options. Whether you’re seeking higher income or greater confidence your capital will be preserved, both play an important role in your portfolio.

.png)

.png)

.png)